List Of Sport Equipment Tax Relief Malaysia

Defination of sports under sports development act 1997.

List of sport equipment tax relief malaysia. There are various items included for income tax relief within this category which are. Interest expended to finance purchase of residential property. Computer annually payment of a monthly bill for internet subscription. A games and sports exemption number.

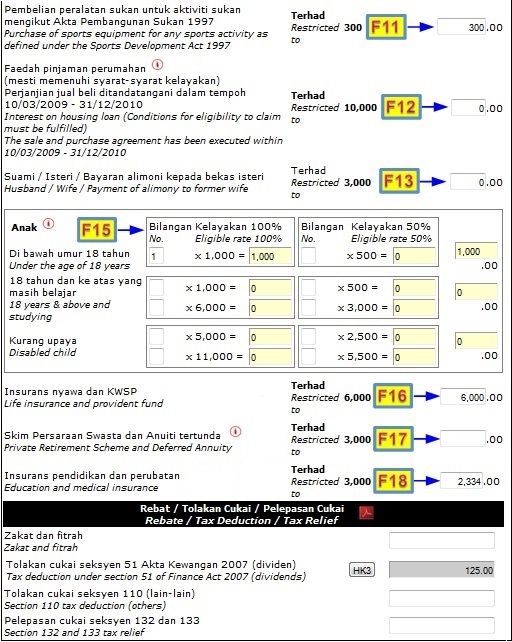

An up to date tax clearance. The easiest mistake to make in claiming income tax relief. Tax relief of up to myr 300 for the purchase of sports equipment for sports activities as defined under the sports development act 1997. The term equipment is not defined and is thus open to discussion.

Purchase of sport equipment for sport activities. Below is the list of tax relief items for resident individual for the assessment year 2019. Relief of up to rm10 000 a year for three consecutive years from the first year the interest is paid. Personal tax relief malaysia 2020.

The following activities are regarded as sports for the purposes of this act. Scenario 1 you only have a medical card which you are paying rm 2 000 annually and you put in the entire rm 2 000 under the insurance premium for medical benefit tax relief. From the year 2008 individual taxpayers are allowed to claim tax deduction of up to rm300 a year on purchase of equipments for sports as defined by the sports development act 1997. Tax relief up to a maximum of rm 300 a year be given on purchase of sports equipment.

You are regarded as an approved sports body if revenue has issued you with a valid games and sports exemption number. Further information on applying for this number is available at sports body tax exemption. Sports equipment and gym membership fees. Refer to this list of the income tax relief 2018 malaysia.

To apply for tax relief on donations your sports body must have. The government has added a lifestyle tax relief during the 2017 budget which now includes smartphones tablets and monthly internet subscription bills. The previous laptop books stationary and sports equipment tax relief is now grouped under lifestyle tax too. Tax relief of up to myr 3 000 for the purchase of a computer to be claimable once over a three year period.

Billiards and snooker 8. The relief amount you file will be deducted from your income thus reducing your taxable income make sure you keep all the receipts for the payments. Purchase of sports equipment sports activity as defined under sports development act 1997 housing loan interest an individual who is a citizen and resident residential property purchased is limited to one unit and not be rented out the s p agreement has been executed between 10 32009 31 122010 deduction for children under 18 years. I the taxpayer is a malaysian citizen and a resident.